Global trade is the lifeblood of the world economy, and at the heart of this intricate web of commerce is trade finance, encompassing a range of financial instruments, including letters of credit, that facilitate the exchange of goods and services across borders. Opening a letter of credit is particularly onerous, requiring coordination among multiple stakeholders, and is often encumbered by protracted, bureaucratic processes with little-to-no transparency for business customers.

But if trade finance is the lubricant that keeps global supply chains running smoothly, what happens when the lubricant starts to dry up? Between 2020 and 2022, a growing trade finance deficit has emerged, rising from $1.7 trillion to a staggering $2.5 trillion. Undoubtedly, the pandemic exacerbated this deficit by triggering economic uncertainty, supply chain disruptions, and increased risk perception, leading to a surge in demand for trade financing while making lenders more cautious. However, pandemic-driven factors can’t account for the entirety of this widening deficit. Rising interest rates, deteriorating economic forecasts, inflation, and geopolitical headwinds have limited banks' ability to provide essential trade financing. Given this perfect storm of challenges, the expanding trade finance gap is at risk of becoming a chasm, greatly undermining the framework of global commerce and further disrupting the flow of international trade.

Root Causes of the Trade Finance Deficit

Many of the factors contributing to the expanding trade finance deficit are interconnected. Rising interest rates make trade financing more expensive for both banks and businesses. As central banks in various countries raise interest rates to combat inflation and stabilize their economies, the cost of trade finance increases, exacerbating the deficit. Banks tend to lean into their inherent risk-averse tendencies in response to negative economic outlooks, making them more reluctant to provide trade financing to businesses in uncertain economic environments. Inflationary pressures may also drive banks’ hesitancy to issue financing due to the fact that it could lose value before it's repaid. Geopolitical tensions – amplified by trade disputes and sanctions – can create uncertainty in international trade, and banks may be hesitant to finance transactions involving countries or industries subject to geopolitical risks.

Implications of the Deficit

The rising trade finance deficit has significant implications for global trade and the world economy. When businesses face difficulties securing financing, it can lead to delays in the production and delivery of goods. The widening deficit has particular implications for smaller businesses and those in emerging economies who will struggle to access global markets without adequate trade financing, hindering their growth and limiting their ability to compete on the international stage. The WTO has reported that SMEs are 7 times more likely to be denied trade financing than multinational companies, giving expression to just how much the deck is stacked against the small business community in the financing realm.

Embracing Tech-Led Solutions

As part of a multifaceted effort to address the trade finance deficit, the development of trade financing options tailored to the needs of SMEs must be a top priority. These businesses often face greater challenges in securing trade financing but play a crucial role in global trade. Even against a backdrop of a fragmented global supply chain, SMEs continue to absorb a substantial portion of global cross-border trade volume – currently estimated at 43% according to the OECD. However, given the stark macroeconomic outlook, SMEs, now more than ever, need swift access to financing to have the best chance of survival.

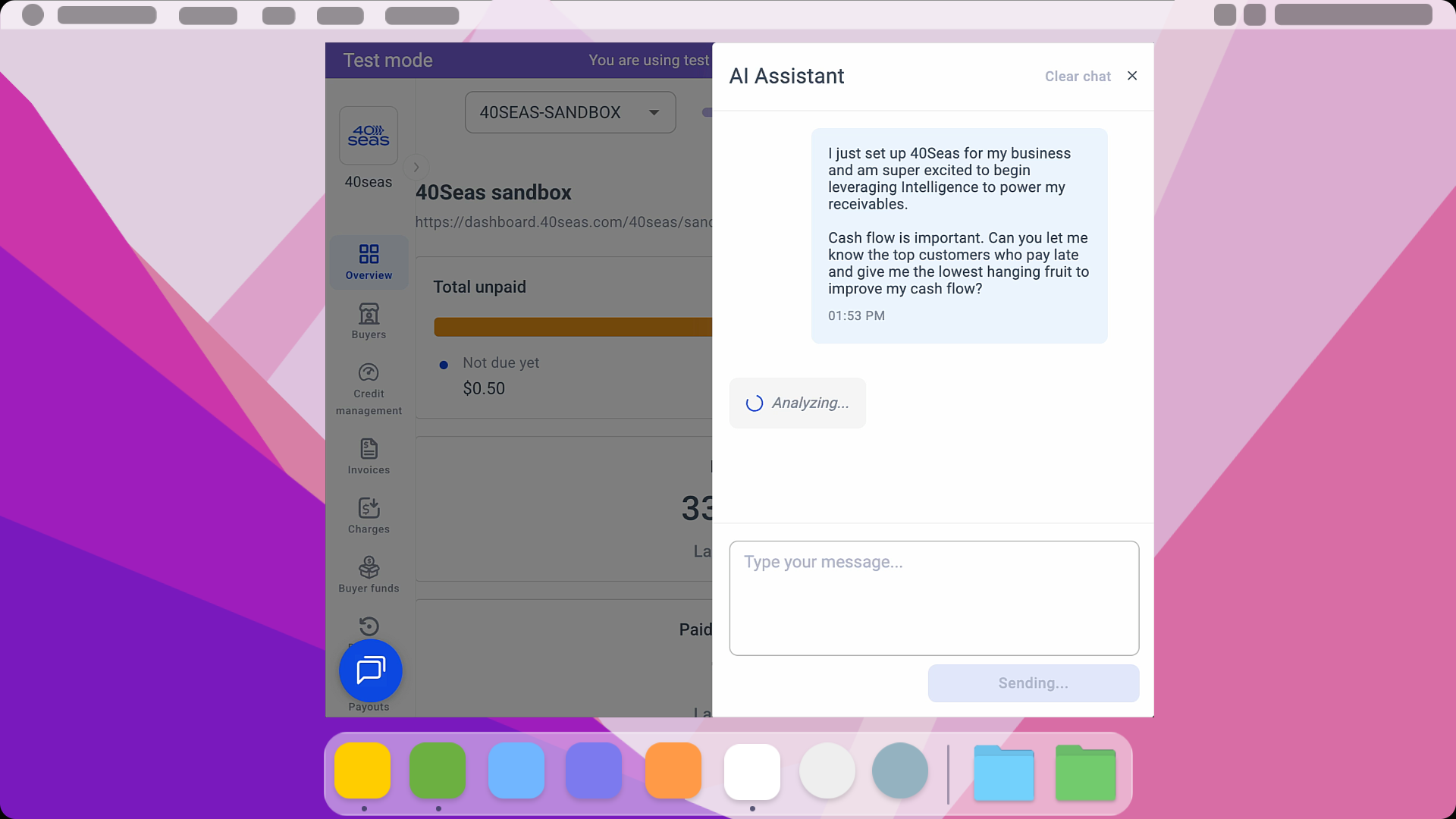

Tech-led innovations hold the key to more streamlined trade finance processes, while helping the underserved SME community navigate an increasingly complex and competitive global marketplace. In a previous blog we outlined how AI can be leveraged to scalably verify creditworthiness and offer flexible payment options that effectively increase the availability of working capital for SME importers, exporters, freight forwarders and sourcing agencies. Given the fact that traditional trade finance institutions and banks simply don’t have the bandwidth or deep tech to analyze companies at a granular level, the case for AI to be harnessed in this regard is compelling. By rapidly analyzing vast troves of financial data, AI can help process financing much more efficiently than legacy offerings.

.svg)