If you’re reading this blog, it’s highly likely that fintech innovations have made your life considerably easier in the past 24 hours. Indeed, off-shoot fintech deployments have seamlessly integrated into the daily routine of countless millions of citizens globally, making transactions, borrowing, and financial management effortless. We’ve all become accustomed to mobile banking apps as well as streamlined international transactions and contactless payments – breakthroughs that have quietly transformed how we interface with financial services.

But what if this wasn’t the case? What if the full benefits of fintech had yet to permeate your daily scope of activities. What if you were still beholden to the clunky, headache-inducing financial services of old? In business parlance, you’d be at a significant competitive disadvantage.

In many ways, this hypothetical scenario has been the reality for SMEs, who, up until recently – have had to grapple with significant challenges when it comes to engaging in cross-border trade, especially in securing the necessary financing for their international transactions. Traditional banking systems have historically made this process cumbersome and expensive, leaving many SMEs struggling to expand their global footprint. Thankfully, the rise of fintech is transforming the landscape for SMEs involved in cross-border trade financing, and not a moment too soon.

The Challenge of Cross-Border Trade Financing for SMEs

Cross-border trade financing has been a longstanding issue for SMEs, who often lack the extensive financial resources and established credit histories of larger corporations. As a result, they face difficulties in obtaining financing from traditional banks and financial institutions who typically require extensive documentation, collateral, and a proven track record before extending credit to prospective clients. The financing hurdles are infinitely more complicated and cumbersome for companies who rely on Letters of Credit (L/Cs) to solve cash flow issues. Overly stringent criteria of traditional institutions mean SMEs are often denied access to essential financing, or face long delays that undermine competitiveness. Traditional trade financing processes can be slow and bureaucratic, and SMEs often find themselves tangled in red tape, leading to delays in securing funds and ultimately getting their goods to market. The intricate nature of international trade, with its varying currencies, regulatory requirements, and inherent risks, adds another layer of complexity.

The Fintech Revolution in Cross-Border Trade Financing

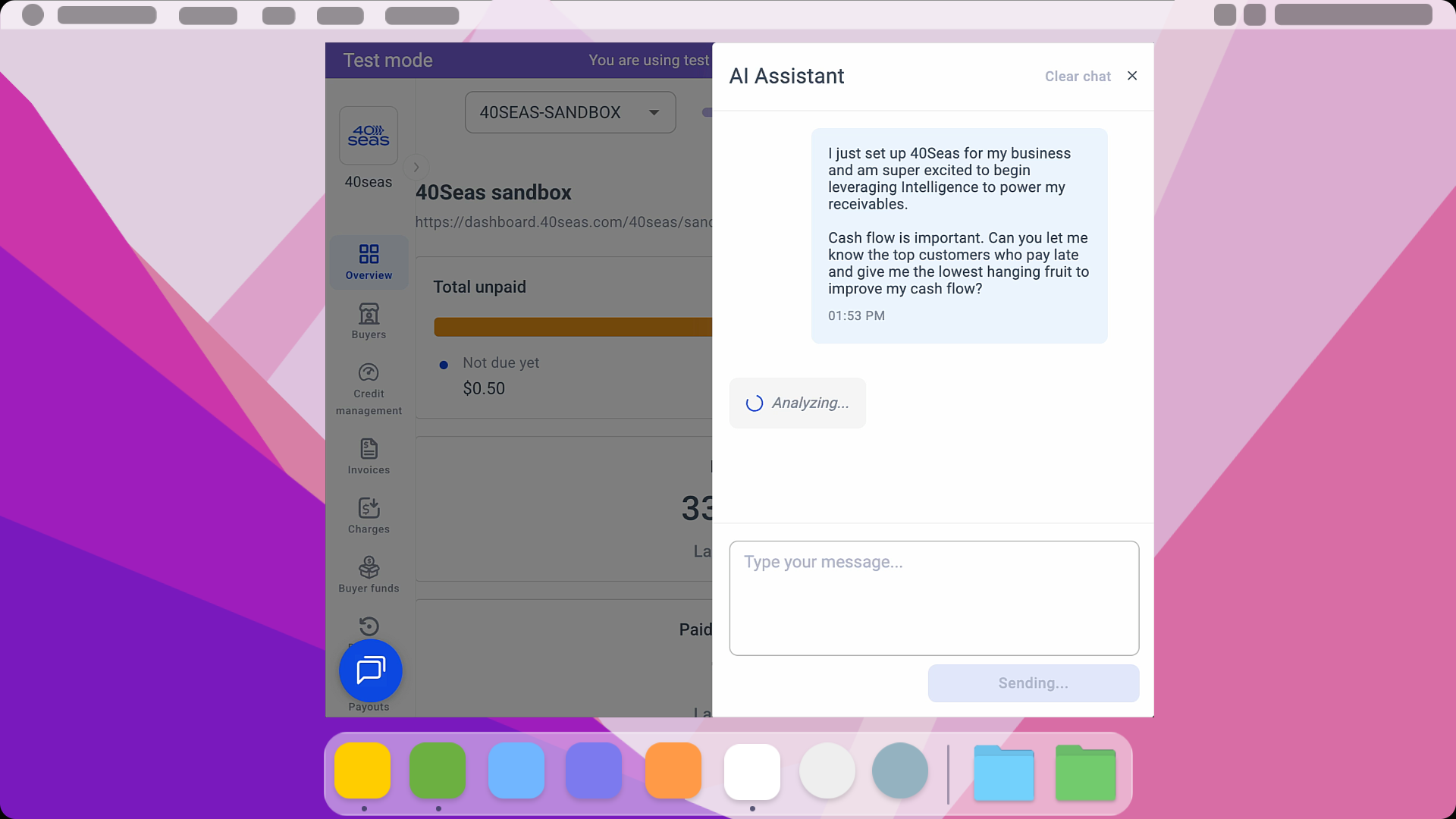

Encouragingly for SMEs, fintech is now heralding a new era in cross-border trade financing, bringing unprecedented benefits to this underserved portion of the global enterprise community. One of the most significant advantages of fintech in cross-border trade financing is the newfound accessibility it provides to SMEs. Unlike traditional banks, which often demand extensive documentation and collateral, fintech platforms are more inclusive, developing innovative ways to assess risk, such as using alternative data sources and credit scoring algorithms.

Fintech leverages big data analytics to assess the creditworthiness of SMEs more accurately, meaning that newer and smaller SMEs have a better chance of securing the financing they need to participate in international trade. By quickly analyzing troves of different data points, including transaction history, online presence, and industry-specific metrics, fintech platforms can offer more tailored financing solutions. This data-driven approach enhances the chances of approval for SMEs, even those without extensive credit histories.

This represents a major stride forward from the traditional trade financing processes – notorious for their sluggishness. SMEs no longer need to wait weeks or even months for their applications to be reviewed and approved. Fintech platforms have changed the game, making the process significantly faster and more efficient. With digital applications and automated underwriting processes, SMEs can secure financing in a matter of hours, enabling them to take advantage of time-sensitive opportunities in the global marketplace.

.svg)